The insurance industry is under digital siege. A rising number of cyber threats target European insurance companies, some of which endured downtime due to the severity of the attack. We've seen an uptick in supply-chain attacks, but the number one cyberattack remains Ransomware. Fortunately, AG Insurance has been spared from major cyber breaches. Here's how we did that.

Patrick Sergysels

Head of Data Management &

Chief Information Security Officer

In this article

Cyber criminals have raised the stakes

Same attack vectors with a twist

Across the finance industry,cyber criminals commonly use credential stuffing, man-in-the-middle and MFA fatigue attacks. However, phishing still leads the pack, preferred for its cost-efficiency and effectiveness.

Nowadays, anyone can hire a phishing-as-a-service provider. These providers help anyone execute the most hard-hitting phishing campaigns possible. With a low entry cost and little technical ability required, they've effectively democratised cybercrime. The upside is significant: last year online nearly 40 million EUR was stolen as result of phishing.

Phishing exploits the weakest link in an organisation's cyber security posture: humans. No matter the delivery methods, these attacks succeed because they either catch the user off guard due to their lack of awareness or uncareful usage of credentials like passwords and usernames.

Cybersecurity is not an afterthought at AG

Despite these threats and possible consequences, many organisations fail to prioritize cybersecurity, frustrating many C(I)SOs in the process. Non-cybersecurity managers often consider cybersecurity a cost rather than an asset, resulting in meagre budgets, lack of resources and having to play catch-up when new risk-prone business projects are developed.

That's where AG stands out. Because of our industry's sensitive nature and significance on Belgium's economy – we manage 65+ billion EUR under assets—we've been prioritising cybersecurity for years. And it shows in different ways. Our department has been blessed with colleagues who are aware of the possible implications and willingly adopt new, more stringent security measures. This awareness translates into our company's procedures.

The measures AG Insurance takes

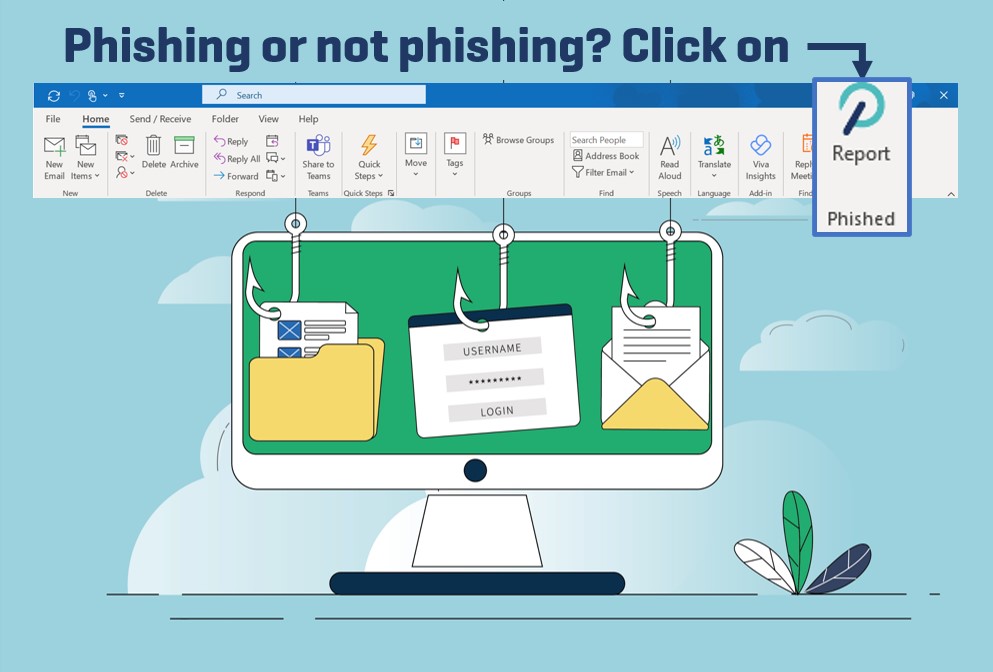

Raising awareness is our number one priority. Given that 8% of Belgians don’t even know phishing, we make a concerted effort to inform our users about its existence, its many forms and its consequences. Recently, we launched an anti-phishing campaign to warn users about the dangers and the signs of phishing. Additionally, we've developed a random testing scheme for our colleagues. We regularly send these to assess our colleagues' ability to recognise and deal with phishing emails appropriately. The fact that our colleagues requested frequent testing is a testament to our awareness efforts.

To complement these, we've deployed a series of technical measures. Our colleagues use up to 15 or more applications per day. Initially, they were required to create complex and unique passwords for each application, but few people actually do that. An attacker would only need to breach one of those applications to get access to all of them.

Instead, we've implemented a single sign-on mechanism, allowing users to access their applications easily. As we're steadily rolling out cloud-based applications in our organisation, we'll develop SSO for cloud environments.

Furthermore, we introduced 2FA. Initially, our colleagues' password was coupled with a PIN code as a second factor on laptops, and an authenticator app on mobile devices, which improved our security posture. Nevertheless, it didn't prevent the phishing of passwords. So, instead of shielding passwords from potential attackers, we took them out of the equation entirely. We're transitioning to a passwordless IAM setup that enables our colleagues to log into their devices with a biometric scan and a device-specific PIN code. By replacing a knowledge factor with an inherence factor, we've significantly reduced a phisher's attacking surface.