AG Insurance is becoming data-driven. We aim to leverage data and new technologies to provide clients & stakeholders with better personalised digital services. Here's why and how we're laying future-proof technological foundations and empowering our teams with a new container-based applications architecture, development tools, and data backbone.

Philippe Van Belle

Chief Information &

Technology Officer

It starts and ends with the "Why"

Vision is critical. Leaders and their teams must clearly understand why and where before embarking on this kind of journey. Our goal is clear: we want to provide our clients and partners with tailor-made digital microservices.

The last thing a client who has just suffered damages wants to do is engage in time-consuming and cumbersome assessments and paperwork. We want to simplify and streamline these experiences to make our clients' and partners' lives easier.

How we're becoming a data-driven and digital company

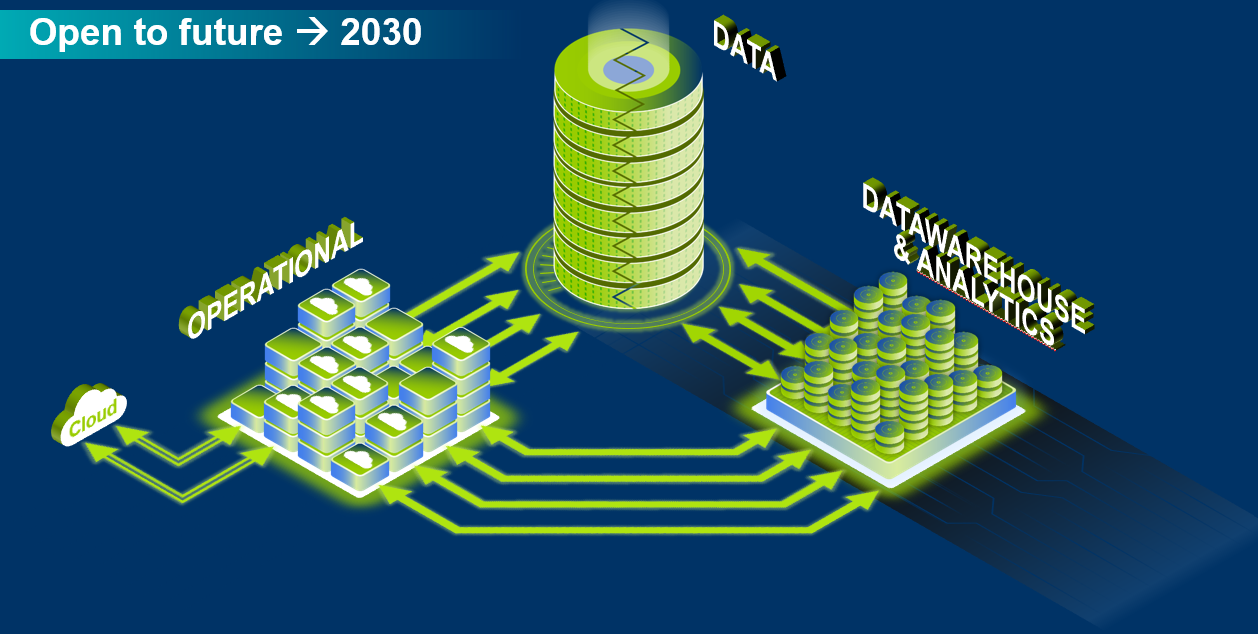

That gap manifested itself in numerous ways. Technologies on both ends of the operations-analytics divide differed significantly and required considerable effort to enable interaction. This resulted in time-consuming data extraction, transfer, transformation, and reloading processes.

But we've since made two major shifts that will progressively enable us to narrow that gap: the replatforming project and the creation of the data platform. The replatforming stands out due to the magnitude of the project. It took us four years, 600 FTEs and the collaboration of six organisations across five continents to migrate all our applications from a mainframe to distributed Windows servers.

Parallel to this, we developed a new cloud-based data platform, significantly enhancing our storage and processing capabilities. Our on-premises platform limited our ability to store vast amounts of structured and unstructured data and perform basic yet essential tasks like timely data reporting. To overcome these limitations, we migrated our analytics and reporting systems from the on-premises SAS environment to Microsoft Synapse.

This strategic shift has been transformative. By running all our operational systems on Windows SQL servers and our analytic data on Microsoft Synapse, we've effectively narrowed the operational-analytics divide. This integration has expedited the delivery of operational data for business use and optimised data ingestion, reducing time to market. Furthermore, it's enhanced our capacity management and enabled us to integrate operational and analytics data through parametrisation, eliminating the need for costly, complex programming.

There's more to it than technology

These new technological foundations bring us closer to our goal, but it's only part of the journey. Fostering a data-centric culture that seeps through every aspect of an organisation is equally important. That's where visionary and inspirational leadership comes in. To succeed, leaders must become champions, assist in developing processes, allocate resources for data initiatives and get buy-in from staff by communicating the value of data. Leaders must inspire their teams to embrace data as a guiding force in their everyday work.

However, getting your IT teams fired up doesn't suffice. It's imperative to involve decision-makers from other departments and have them latch their wagons to your data locomotive.

One way to do that is by fostering cross-functional collaboration and communication. When data professionals and business teams work together, they're exposed to diverse perspectives that lead to new insights. Furthermore, clear and concise communication of data findings enables decision-makers to leverage data to drive impactful outcomes.

Decision-makers will only be comfortable leveraging data when they trust it. Trust is flimsy and hard to measure, but we can cultivate it by implementing data governance practices that guarantee data reliability, accuracy, and consistency. Transparency about those practices and the commitment to maintaining data quality is critical in building a solid foundation of trust in an organisation's data-driven pursuits.

As trust in our data strengthens through these measures, it paves the way for broader organisational engagement, fostering a culture where our technological foundation is the core of every business project portfolio.

The end goal: real-life benefits for our clients and partners

That client would only need to take pictures of the damage and upload them to our app to alert their broker. An analytic algorithm would then assess and calculate the damage based on that picture by comparing it using visual data from similar instances. Integrating this analytical process with the operational side would enable us to pay the insurance payout automatically and immediately.

This is only one possible example of how our technological and cultural improvements position us to provide our clients with better services and our partners with the tools to deliver those services.

Conclusion

Our commitment to data-driven innovation has uncovered a plethora of new client-centric solutions. By bridging the gap between operational systems and analytics and fostering a data-centric culture, we've harnessed the transformative power of data to provide all our stakeholders with innovative tools and clients with efficient digitised services.

The journey towards becoming a data-driven company goes beyond developing an app or an analytics algorithm. It's fundamentally about laying future-proof technological foundations that can support a transformative, digitised, and data-driven universe. By sharing our experiences and insights, we hope to inspire others to embark on their own transformative paths. Stay tuned for new stories on how we strive to unlock new opportunities for innovation, efficiency, and customer satisfaction.