Only available in English

Relevant information of interest to analysts and debt investors

In this section, you will find all relevant information of interest to analysts and debt investors.

You can access items such as our funding programs, ratings and rating reports and investor presentations.

The Investor Relations team is of course available to answer any additional questions you might have concerning these subjects.

Site content is protected by our Disclaimer Investor Relations document.

Solvency and Financial Condition Report (SFCR)

Solvency II, the risk-based supervisory framework for the insurance sector that came into effect on 1 January 2016, requires insurers to determine a solvency capital requirement (SCR) that it is sufficient to cover any losses in a one-year horizon with 99.5% confidence. Insurers can choose whether they use the standard formula or an internal model to determine the SCR.

The standard formula consists of pre-defined shocks for a number of relevant risk types (insurance, financial and operational risk) and a relatively simple aggregation methodology. Calculations start from a market-consistent balance sheet with assets and liabilities assessed at fair value to the greatest extent possible.

By using an internal model, or a partially internal model, insurers can develop their own methodology for determining the SCR. In addition to this quantitative part of the framework, the governance requirements and the need to have an adequate risk management system and function in place are equally important. Finally, the third pillar of the Solvency II framework requires a number of reports to be drawn up in order to informing the relevant stakeholders (supervisor, clients, investors, etc.) in a transparent way, hence fostering market discipline.

One of these reports, the Solvency and Financial Condition Report (SFCR), is now available. It is meant to provide the reader with insight into the business of AG, the way the Company is organised, the structure and components of the risk management in place, the risks it deals with and, last but not least, its financial soundness as reflected in the solvency ratio.

Shareholding structure

- Ageas is an international insurance group active primarily in Europe and Asia.

- BNP Paribas Fortis, a subsidiary of the global BNP Paribas group, is Belgium’s largest bank.

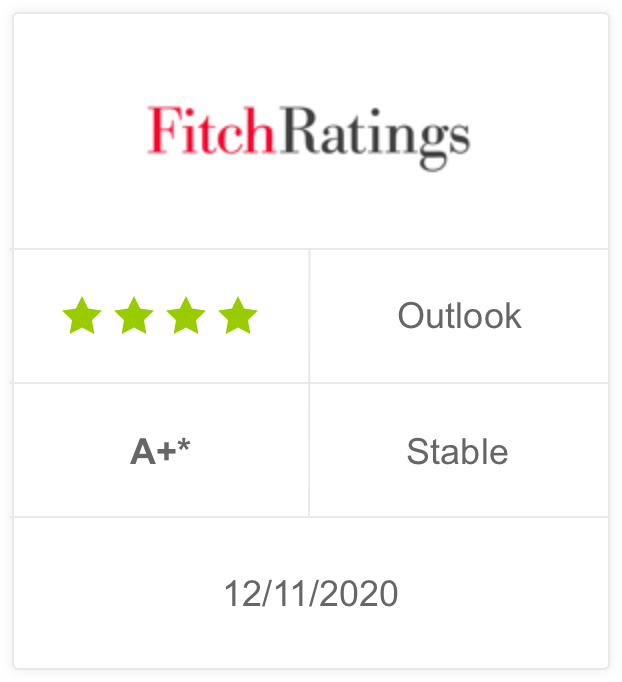

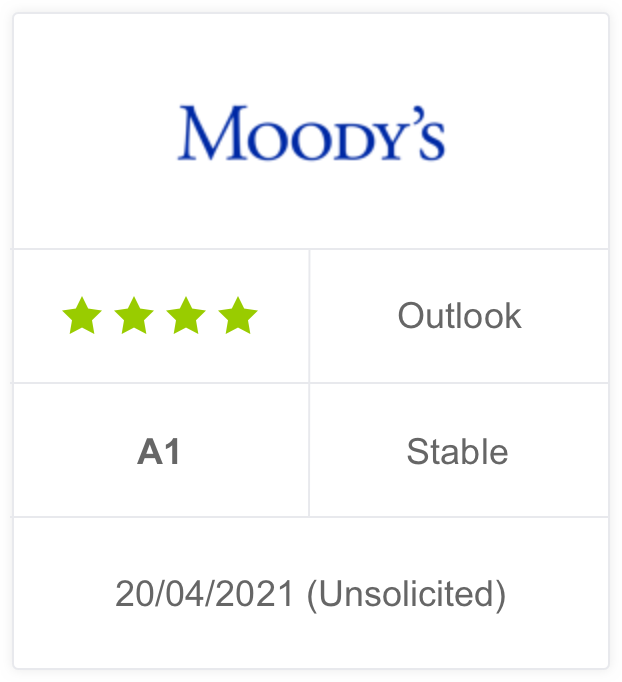

Ratings of AG:

* Only for "Insurer Financial Strength"

Definitions (Standard & Poor’s website):

Issuer Credit Ratings: A Standard & Poor's issuer credit rating is a forward-looking opinion about an obligor's overall creditworthiness. This opinion focuses on the obligor's capacity and willingness to meet its financial commitments as they come due. It does not apply to any specific financial obligation, as it does not take into account the nature of and provisions of the obligation, its standing in bankruptcy or liquidation, statutory preferences, or the legality and enforceability of the obligation.

Counterparty credit ratings, corporate credit ratings and sovereign credit ratings are all forms of issuer credit ratings. Issuer credit ratings can be either long-term or short-term.

Insurer Financial Strength Ratings: A Standard & Poor's insurer financial strength rating is a forward-looking opinion about the financial security characteristics of an insurance organisation with respect to its ability to pay under its insurance policies and contracts in accordance with their terms. Insurer financial strength ratings are also assigned to health maintenance organisations and similar health plans with respect to their ability to pay under their policies and contracts in accordance with their terms.

This opinion is not specific to any particular policy or contract, nor does it address the suitability of a particular policy or contract for a specific purpose or purchaser. Furthermore, the opinion does not take into account deductibles, surrender or cancellation penalties, timeliness of payment, nor the likelihood of the use of a defence such as fraud to deny claims.

Insurer financial strength ratings do not refer to an organisation's ability to meet non-policy (i.e., debt) obligations. Assignment of ratings to debt issued by insurers or to debt issues that are fully or partially supported by insurance policies, contracts, or guarantees is a separate process from the determination of insurer financial strength ratings, and follows procedures consistent with those used to assign an issue credit rating. An insurer financial strength rating is not a recommendation to purchase or discontinue any policy or contract issued by an insurer.

Funding programmes

| BE6261254013 | BE6277215545 |

|---|

ISIN Code |

BE6261254013 |

BE6277215545 |

Country of Listing |

Luxembourg |

Luxembourg |

Currency |

EUR |

EUR |

Issue Date |

16/12/2013 |

31/3/2015 |

Maturity |

Dated (30.5 NC 10.5) |

Dated (32 NC 12) |

Nominal Value |

EUR 450,000,000 |

EUR 400,000,000 |

Coupon |

5.25% |

3.50% |

Coupon Payment |

Annually |

Annually |

Smallest Denomination |

EUR 100,000 |

EUR 100,000 |

Rating |

_ |

S&P: BBB+ |

Bond trading level |

Contact

Questions?

The Investor Relations team is of course available to answer any additional questions you might have concerning these subjects.

Offering documents

You can access our offering documents (prospectus) by clicking on following button.

You will have to read and accept our Terms of Use in order to access the offering documents.