Register for the Pension & Health Academy webinar on Thursday 24 October (Dutch session) or on Tuesday 5 November (French session), where we'll be covering the key points and implications of the LCP rate hike!

Deposits into a supplementary pension plan by law have to yield a minimum return each year. This is stipulated in the Supplementary Pensions Act (WAP/LPC) and is therefore called 'WAP/LPC rate'. The WAP/LPC rate must stay within the range of 1.75% and 3.75%, and is calculated annually based on Belgian 10-year government bond (OLO) rates.

Due to the low interest rates, the WAP/LPC rate has remained fixed at 1.75% over the past few years. That is set to change. From 2025, as an employer, you will have to guarantee a return of at least 2.50%

What exactly is this guaranteed minimum interest rate of 2.50% on? There are important distinctions:

- for branch 21 group insurance policies (with guaranteed returns), the new minimum interest rate will in principle only apply to new premiums,

- for branch 23 & branch 44 group insurance, the new minimum interest rate applies in principle to everything.

This means that for branch 21 group insurance, the higher minimum interest rate applies in most cases only on the new premiums, while for the other formulas, the entire pension reserve is usually subject to this rate. This can lead to a significant difference in the final payout.

Higher capital on retirement

The higher minimum interest rate also increases the minimum capital you must guarantee your employee at retirement or at the time of transfer of reserves to a new employer's pension plan.

The exact effect will be different for each employee. It is not only the type of pension plan that plays a role, the impact will also vary depending on how long an employee has been a member of your pension plan.

An interest rate that goes up from 1.75% to 2.50% can easily result in a more than 20% increase in the minimum final payout for younger employees who stay with the same employer for their entire career!

With AG you are in for a treat

While past results do not guarantee future returns, our healthy returns over the past few years do show that AG is a great choice for your retirement plan. We offer you a wide range of innovative solutions in which the final payout is likely to be a lot higher than the statutory minimum.

Group insurance policies at AG invest in funds within branch 21, branch 23 or a combination of both. These funds are doing extremely well.

Branch 21 provides security (guarantee of reserves):

- A guaranteed return each year, with possible profit sharing

The investment of premiums is managed individually, linked to the AG Employee Benefits General Fund. This has been offering a yield of 1.75% since 1 January 2024.

In addition, the guaranteed interest rate can be topped up each year with a profit sharing, increasing the net total return.

- Attractive net total return

The average net total return on average growth through premiums in 2023 was at least 2.50%.

- A highly diversified asset mix

A good spread across many assets makes for a safe investment portfolio with stable growth and healthy cash flow.

Branch 23 offers great prospects for returns:

- A wide choice, according to your risk profile

These funds, with no guaranteed return, offer appealing long-term return prospects. You choose whether to take a lower or higher amount of risk.

- Managed by the world's best fund managers

A unique, professional approach ensures that all funds are optimally managed.

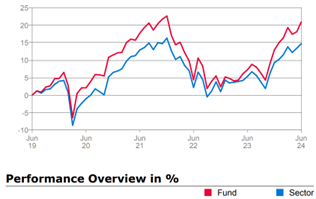

- Excellent historical returns

In recent years, our Branch 23 funds have produced great returns.

The return from the Rainbow Green fund (50% bonds and 50% shares) stands at 3.87% over 5 years (as at 30-06-2024).

- On the AG EB Invest Dashboard, you can view and track the performance of our branch 23 funds at any time.

What does the future hold?

For the first time in eight years, the statutory minimum return on supplementary pensions (the LCP rate) is set to rise. There are enormous challenges ahead for the second pillar. Many employers and HR managers are wondering about the steps they'll need to take and the impact on their pension plans. No wonder the Pension Forum 2024 at the AG Campus attracted such a big crowd.

Unable to attend? Then you won't want to miss the webinar!

In any event, you can still register for the Pension & Health Academy webinar on Thursday 24 October or Tuesday 5 November (1:00 - 2:00 pm), where we'll be covering the key points and implications of the LCP rate hike!