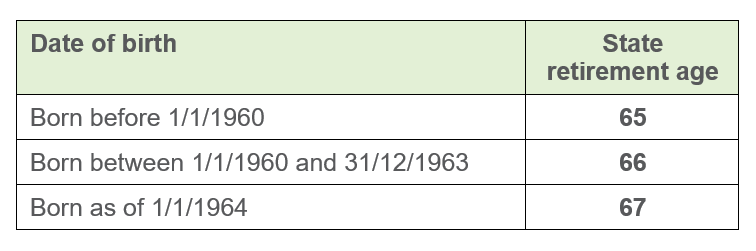

The decision to gradually increase the retirement age was taken several years ago, by a previous federal government. This is the first year it comes into effect: the state retirement age will now be 66. The next change will happen in 2030, when the state retirement age will go up to 67.

The increase in detail

Statutory retirement

The increase in the state retirement age to 66 applies to employees born between 1 January 1960 and 31 December 1963.

Early retirement

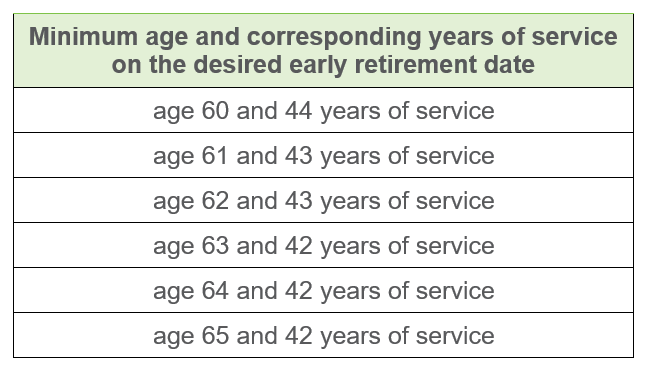

The minimum age and required years of service for early retirement will remain unchanged.

Implications for your pension plans

Have you set up your staff members with an AG supplementary pension plan? Then you're in good hands: your pension plan is ready for the future!

Your employees will remain enrolled in your plan (supplementary pension and death benefit coverage) as long as they continue to work and do not take statutory retirement. The guaranteed interest rates for their supplementary pension will remain applicable until the retirement age stipulated in the pension plan regulations. After this date, the guaranteed interest rate applicable at the time the end date of the plan is extended will also be extended, where applicable.

There will be no change in the tax rates or conditions to claim payment of the plan proceeds. Tax rates on supplementary pension proceeds vary according to the time of payment: the earlier the employee retires, the higher the taxes. Note that to be eligible for the more favourable tax rate of 10.09%, your employee (except in the case of a full career) must remain actively employed until the statutory retirement age. For employees born between 1/1/1960 and 31/12/1963, this is age 66.

Here you will find an overview of the applicable rates and specific conditions.

Finally, the higher state retirement age has no impact whatsoever on the death benefit coverage.

Implications for your healthcare plan

For most of these plans, the end date is linked to the effective retirement date. Is the end date of your plan still set at age 65? If so, you will receive a letter from us this spring to align the texts of your convention with the increased retirement age to 66.

Your employees will therefore be covered until the age of 66 if they are still working by then.

Implications for your income protection and waiver of premiums covers

These plans also do not require you to take any steps yourself.

Most plans already offer coverage through age 67. If you still have a plan whose coverage stops at age 65, you will also receive a letter this spring to align the texts of your convention with the increased retirement age to 66.

Specific questions? Need more information?

Do you have any questions about the increase in the state retirement age and the implications for your group insurance plans? Simply make an appointment or call your regular contact person.

Do your employees have questions? Be sure to refer them to MyAG Employee Benefits, where they will find an overview of all of the supplementary covers you have taken out for them, the size of their supplementary pension nest egg and answers to the most frequently asked questions.