The special social security contribution for high supplementary pensions, known as Wijninckx contribution, came into force in 2012. Following a period of temporary measures, the definitive regime has been in effect since the beginning of 2019. In this article, we'll cover everything you need to know about this contribution.

IMPORTANT

As part of the pension reform, on 18/12/2025 the parliament amended several social contributions on the supplementary pension, including the Wijninckx contribution, which increases from 3% to 12.5%, starting from the contribution year 2026.

What exactly does the Wijninckx contribution entail?

The Wijninckx contribution is a special social security contribution for supplementary pensions set up by employers or companies for their executives. The mechanism is triggered if, on 1 January of the year prior to the contribution year, the supplementary pension accrued by the employee or executive (converted into an annuity and added to the accrued statutory pension) is higher than the maximum statutory pension in the public sector, taking into account the number of years already served by the employee or executive.

If this amount is exceeded, a contribution representing 3% of the increase in supplementary pension reserves in the year prior to the contribution year is currently due. Starting from the 2026 contribution year, this contribution will increase to 12.5%.

Sigedis (manager of the second pillar database DB2P) is responsible for collecting all necessary data from the pension institutions. It calculates this contribution on the basis of this data.

How is the Wijninckx contribution calculated?

For each employee and self-employed person with a supplementary pension plan, Sigedis calculates whether a special social security contribution is due by following these steps.

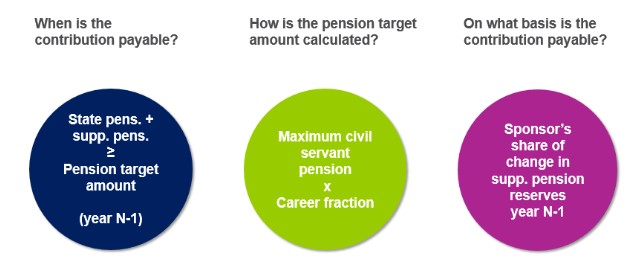

Step 1: Is a contribution payable?

The contribution is due if the sum of the statutory pension and supplementary pension of the employee or self-employed person exceeds the statutory 'pension target'. This threshold is equal to the maximum statutory pension for the public sector on 1 January of the previous year.

- Second-pillar supplementary pension reserves are expressed as an interest rate;

- The statutory pension is currently estimated on a flat-rate basis and multiplied by the career fraction;

- The maximum pension of a civil servant is 95,636 euros (01/01/2024) multiplied by the career fraction.

This formula determines the second-pillar pension reserves above which a contribution is payable. The following "Wijninckx thresholds" apply for the 2025 contribution year:

| Number of career years completed on 01/01/2024 |

Total second-pillar pension reserves on 01/01/2024 |

|

| Employees | Self-employed | |

| 1 | EUR 37,042.23 | EUR 51,251.13 |

| 5 | EUR 185,211.15 | EUR 256,255.67 |

| 10 | EUR 370,422.31 | EUR 512,511.34 |

| 20 | EUR 740,844.62 | EUR 1,025,022.67 |

| 30 | EUR 1,111,266.93 | EUR 1,537,534.01 |

| 40 | EUR 1,481,689.24 | EUR 2,050,045.34 |

| 45 | EUR 1,666,900.39 | EUR 2,306,301.01 |

Step 2: How much is the Wijninckx contribution?

If the pension target is exceeded, a contribution is payable by the organiser on its part of this year's increase in pension reserves compared to last year.

For the 2025 contribution year, this comes to:

2025 contribution = 3% x (pension reserve on 01/01/2025 - pension reserve on 01/01/2024*)

For the 2026 contribution year, this gives:

Contribution 2026 = 12.5% × (pension reserve as of 01/01/2026 – pension reserve as of 01/01/2025*)

* The pension reserve on 1 January of year N-1 is adjusted for the capitalisation already carried out.

How will you be notified that the contribution is payable?

If you owe a Wijninckx contribution for your employees or self-employed persons, Sigedis will inform you in October:

- Either through your e-Box (the secure digital mailbox available via the Social Security portal);

- Or by regular post if your company is not yet registered on the Social Security portal.

The payment procedure itself remains unchanged:

- In the case of employees, you must declare and pay the amount due to the NSSO together with your DmfA declaration and payment for the fourth quarter of the contribution year;

- In the case of self-employed professionals, the amount due must be paid to the NSSO no later than 31 December of the contribution year.

Note: The calculation takes into account all the pension reserves of the plan participant (including those accrued with previous employers). Only Sigedis knows this information. For more details on the calculation, you may want to visit the Supplementary Pensions Database (DB2P) website:www.db2p.be.

Questions ?

Please don't hesitate to reach out to your trusted contact person at AG.