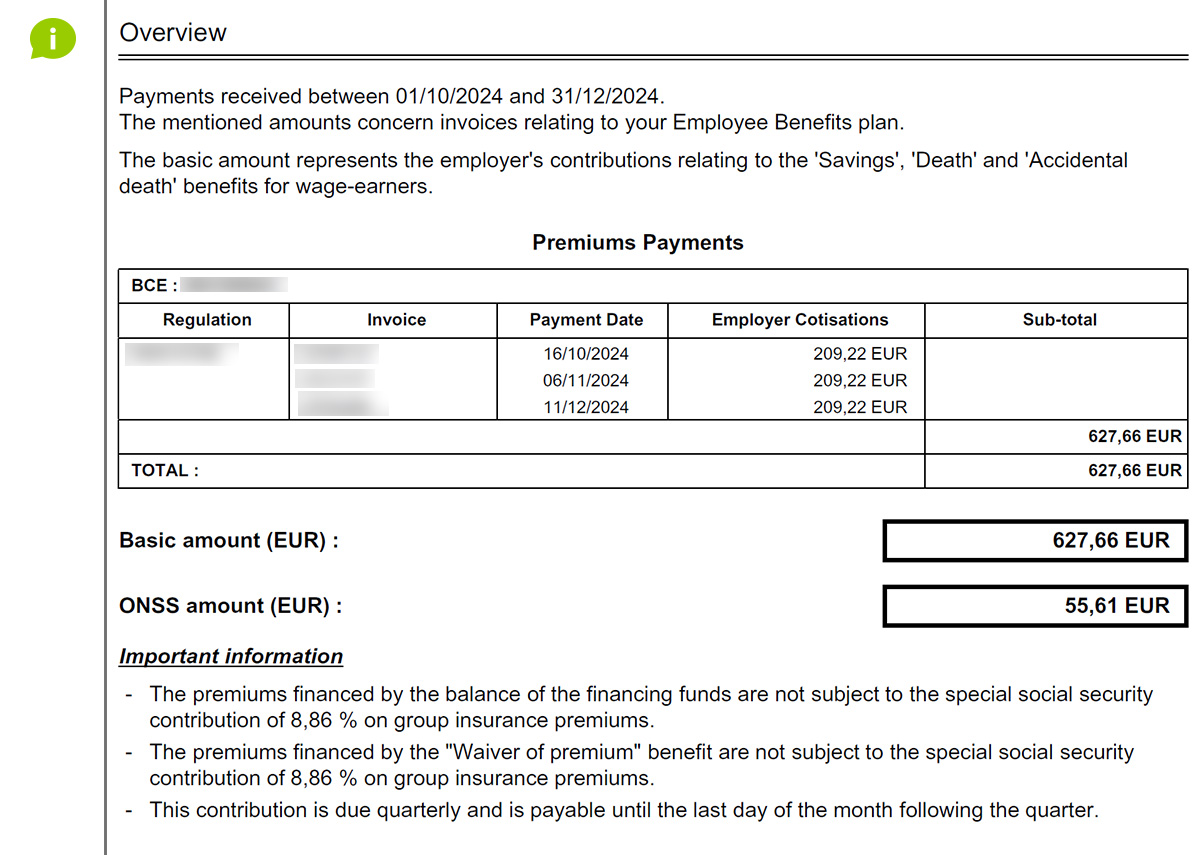

Definition & content

ONSS is the National Office for Social Security.

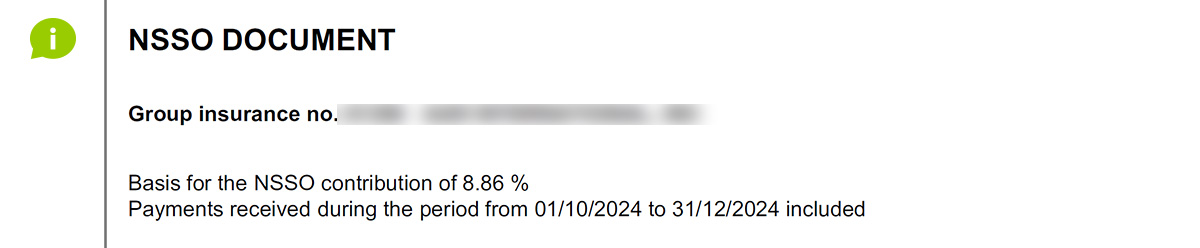

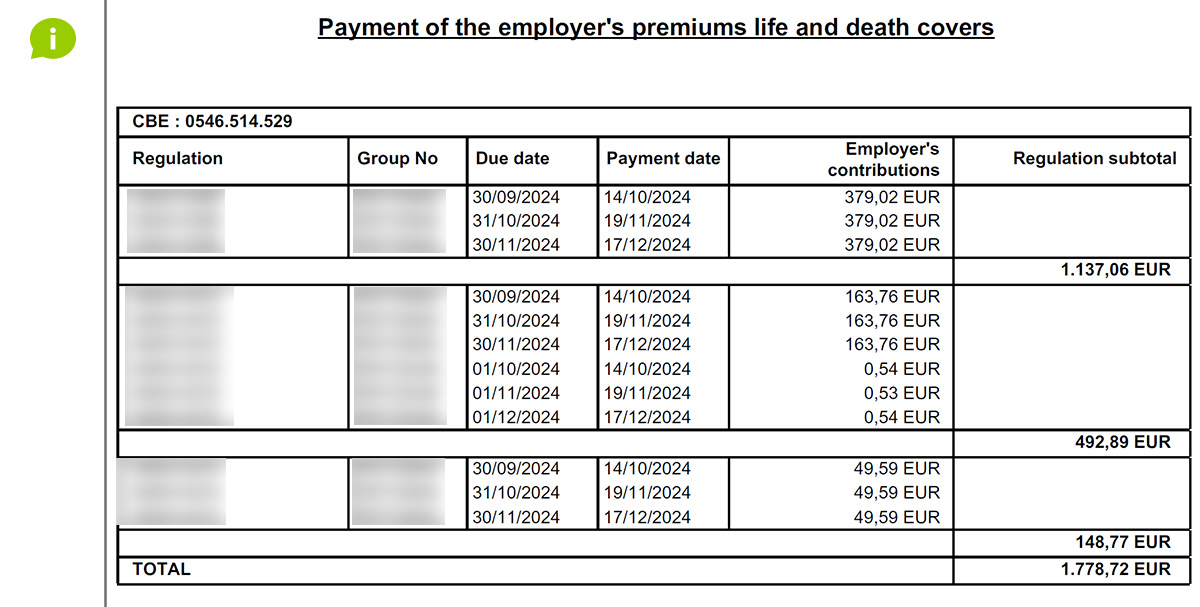

For coverages Life and Death/Death by accident, a NSSO contribution of 8.86% is due on the employer premiums actually paid by the employer. These contributions are applied after deduction of the 4.40% tax and of any reductions in administrative or management costs paid into the employer's account. The employer must declare them quarterly.

In order to facilitate this declaration, AG issues a document containing the necessary information at the end of each quarter. This document is purely informative. You do not have to pay this NSSO contribution to AG, but directly to the NSSO, at the latest on the last day of the month following the quarter in which the premiums are paid.

How is the NSSO contribution calculated?

The NSSO contribution is calculated only on the 'Employer' premiums paid for Life and Death/Death by accident benefits. No social security contributions are due on the premiums payable by employees, nor on the premiums paid for the Health Care, Income Protection or Waiver of Premiums coverages.

In the calculation of the NSSO contribution, premiums claimed but not yet paid are not taken into account. The premiums are only included in the basic amount of the NSSO overview if they have actually been paid.

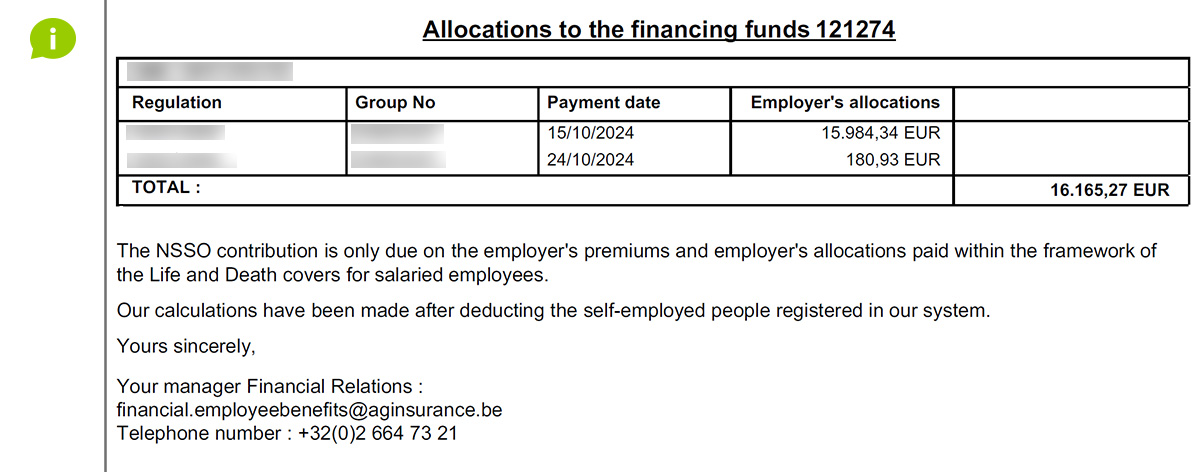

Payments into the financing fund are considered to be payments from the employer and are therefore also subject to the NSSO contribution.

Premiums for the self-employed are not taken into account in the calculation of the NSSO contribution, even if they have been paid by the company.

What information can be found on the NSSO document?

The NSSO document includes:

- payments received during the last quarter

- any allocations to the financing fund(s)

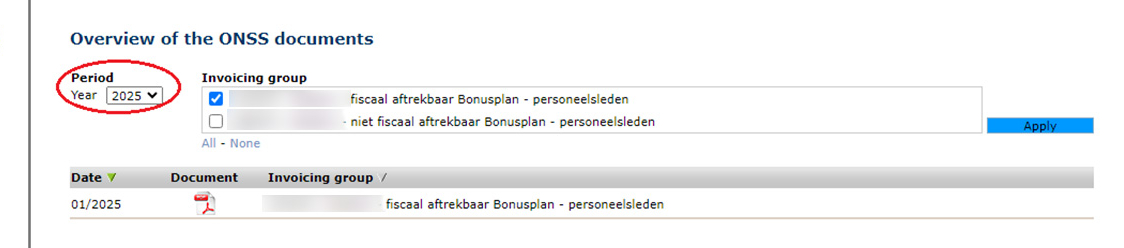

When is the NSSO document available on AG EB Online?

Quarter concerned |

Publication on AG EB Online |

January-March |

Beginning of April |

April-June |

Beginning of July |

July-September |

Beginning of October |

October-December |

Beginning of January of the following year |