Income Care income protection insurance

Employees in Belgium are taking extended sick leave in skyrocketing numbers, and the figures keep rising every year. While our social security system provides a financial safety net, state benefits are quite modest, enough to cover essential living expenses only.

You'll be providing your staff members with more than a financial cushion. You can enhance the well-being of your staff members with My Mind by AG, and get them back to work safely, successully and sustainably with a custom-designed return-to-work assistance programme in the event of a stress-related mental disorder.

A more competitive salary package

On this page:

Why is it so important to have income protection insurance?

An accident, critical illness, stress, burnout, maternity leave... there are multiple reasons to be off work for an extended period.

With Income Care, your staff members will have a monthly replacement income to fall back on if ever they are off on occupational incapacity leave.

What purpose does income protection insurance serve?

The social security system only covers a portion of the salary

In the first month of occupational incapacity leave, staff members will still collect 100% of their salary, payable by the employer.

Between the 2nd and the 12th month, the employer generally stops paying their staff for sick leave. Instead of a paycheck, they’ll have to rely on state benefits, which are just 60% of their gross salary.

After one full year, the occupational incapacity will be reclassified as a disability. Staff members will then be entitled to an allowance according to their marital/family status, which is for example just 40% of the gross salary if married or in a registered domestic partnership.

Salary cap and exclusion of other earnings and benefits

When calculating the disability benefit, the INAMI/RIZIV applies a maximum annual salary cap of EUR 57,137.59 or EUR 4,761.47 on a monthly basis (last update: February 2025). The higher the salary, the greater the loss of income.

Anything above this cap, but also other earnings and benefits such as year-end bonuses, performance bonuses, meal vouchers, etc., are excluded from the calculation.

Employees aren't always aware of this salary cap. 2 out of 3 employees overestimate the size of the state benefits they'd be entitled to collect.

Want to check the size of your state benefits yourself? Try our simulation tool.

What's in it for you as an employer?

In addition to being a must-have for your staff members, income protection insurance also offers several interesting benefits for you as an employer:

Barely 1 out of 5 employees in Belgium have occupational incapacity coverage. By offering a group income protection plan, you can differentiate your company and raise your profile as a caring employer, an important attribute for many job seekers in the current market.

Research shows that employees greatly value income protection insurance. This type of coverage gives you a competitive edge in the war for talent.

With Income Care, you’ll help move your company to the top of your candidates’ consideration list and have an extra sweetener to retain your top talent.

What's more, according to our study published in the "Cost of Absenteeisme" whitepaper, the positive emotional environment created by a caring climate can significantly impact how staff members feel and function in their professional lives. In short, working for a caring employer reduces the risk of stress-related absences.

A variety of tools to help you combat absenteeism

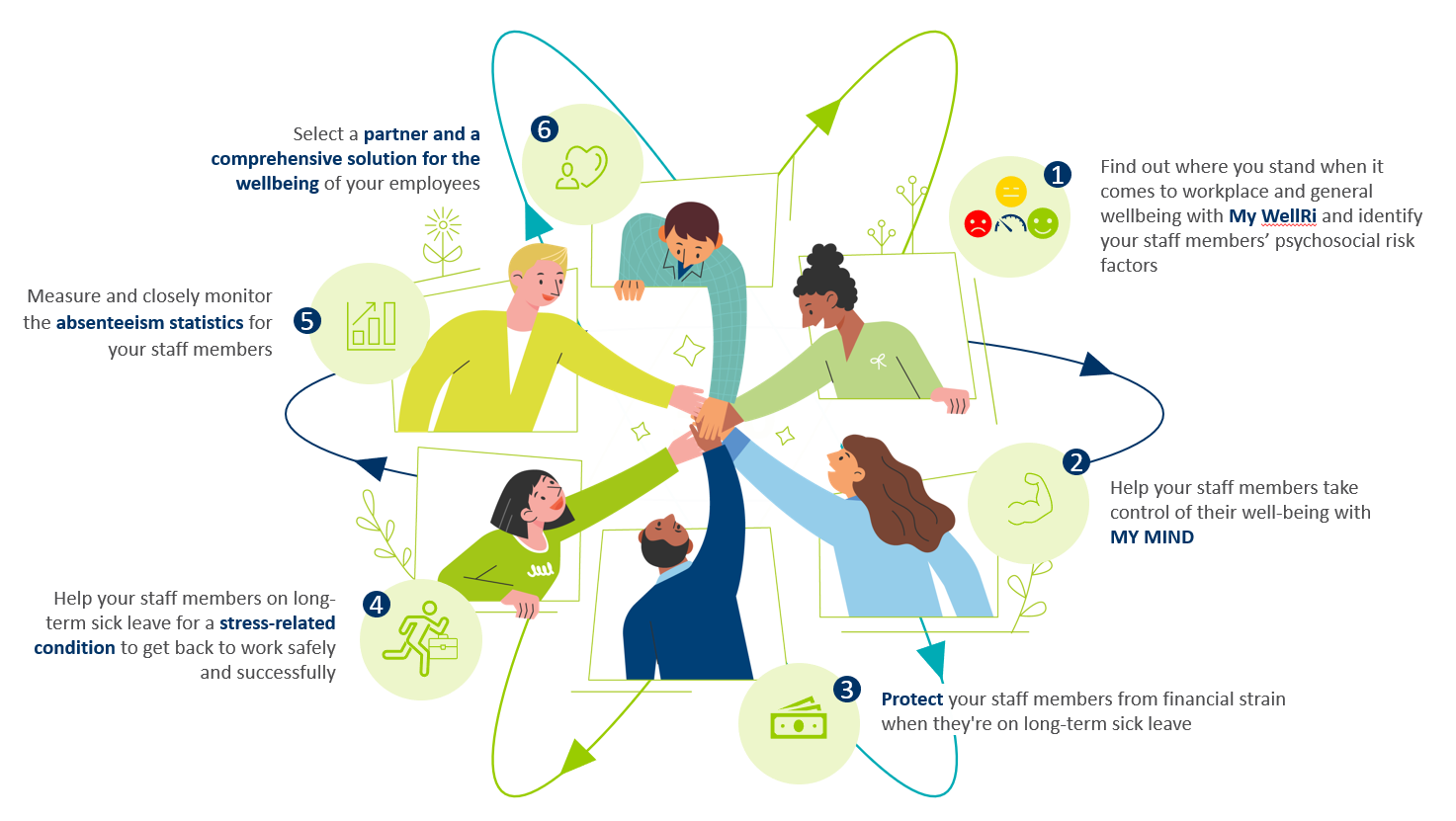

Offering a financial safety net is no longer enough: a holistic approach is what's needed to prevent long-term absenteeism.

As the first market player to include Return to Work assistance in its insurance coverage as of 2017, AG has continued to meet the needs of its customers by also launching prevention services in 2019, now under the name of Waldon:

- My WellRi, a quantitative and scientific assessment of your employees’ general and workplace wellbeing

- My Mind by AG, a range of self-care tools to enhance your employees' mental resilience

In addition, for certain customers (if they can preserve the anonymity of the data), a Return to Work dashboard is available to track the evolution of mental disorders, measure employee satisfaction with the solution, and compare their results with other companies.

It’s up to you to decide what to include in your income protection plan

Tailored to your company's specific needs

Income Care offers a solution for many employees, but also for you. With this coverage, you can raise your profile as a caring employer. For optimum protection, you determine the scope of coverage yourself, depending on your company's needs.

Select the covers to be included

- incapacity benefit

- waiver of premiums

Set the insured risk

- illness

- non-occupational accident

- occupational accident

Select the incapacity benefit type

- offset

- step-rated

- lump sum

Customise the coverage and select

- the waiting period

- the indexation for benefits

- the maximum annual benefit amount

Want to find out more?

You'll find more details on how Income Care works in this handy guide.

And, of course, you are always welcome to contact us if you have any questions or need individually-tailored advice. Send in your questions about income protection insurance or request a non-binding quote for Income Care, and we’ll get back to you as soon as we can.