Find out how to stay one step ahead of these changes.

In 2026, the Transparency Act will introduce two major changes affecting supplementary pensions. Worried that your HR staff will be bombarded with questions? Read on to find out how to make things crystal clear for them.

To make information about the second pillar clearer and more relevant, uniform rules will be applied across all pension institutions. For example, as of 2026, your staff members will get two new documents: the Supplementary Pension Information Sheet and the Pension Overview Statement. The Overview will replace the tried-and-true benefits statement, but provides a recap of the previous year's amounts only.

For your convenience, we've provided a brief description of these two new documents below.

🆕 Supplementary Pension Information Sheet

While the term commonly used in legal and media circles has been "enrolment document", the official name of this document is the "Supplementary Pension Information Sheet". It's a standardised pension plan summary for new participants: who manages the plan, what are the costs, who pays the contributions, how are the benefits paid out, and so on.

The purpose of this document is to provide your staff members with a general overview of their group insurance plan, inform them about their selection options and tell them where they can find all the details.

In 2026, all new plan participants will have access to the Information Sheet in MyAG Employee Benefits, along with the complete Pension Plan Regulations. AG will also send it to Sigedis, so that it can be uploaded to mypension.be.

Yes, you read that right: this new Information Sheet does not apply to your current plan participants. But to make sure they stay informed, they'll also be able to view their complete Pension Plan Regulations in MyAG Employee Benefits from 2026 onwards.

🆕 The new Pension Benefit Statement

The annual Pension Benefit Statement is a legally required document for all pension institutions. It's drawn up by Sigedis, based on the figures we provide.

It replaces the old benefits statement and will be available at the end of each year, on mypension.be as well as MyAG Employee Benefits.

The first new Pension Benefit Statement will be available in 4Q26, with the figures on 31/12/2025 (calculated based on the 2025 salary information). What if your staff members want the most up to date overview of their supplementary pension benefits? They can find that information at any time in their MyAG Employee Benefits app.

What's the difference compared with the current benefits statement?

The basic information on the new Pension Benefit Statement is the same as on the current benefits statement (vested reserves and benefits). However, there are two very big differences:

- DIFFERENCE 1: projected pension benefits (simulated retirement benefit)

If you have a Defined Contribution pension plan, from now on, your staff members will be given three different projections: optimistic, realistic and pessimistic. The projected amounts will be calculated based on interest rates published annually by the FSMA, with the statutory retirement age as the maturity date. This means that neither the interest rate guaranteed by AG nor the retirement age stipulated in the plan will be taken into account.

For Defined Benefit and Cash Balance plans, the benefit amount will now also be calculated based on the statutory retirement age. Note that these three projections will only be shown if a portion of the benefit amount is variable (e.g. profit sharing on top of the DB formula or Cash Balance return linked to financial products).

With this new calculation method, it's now impossible to compare the benefit amounts on the new Pension Benefit Statement with the figures on the current benefits statement, even if one replaces the other.

- DIFFERENCE 2: the "current account"

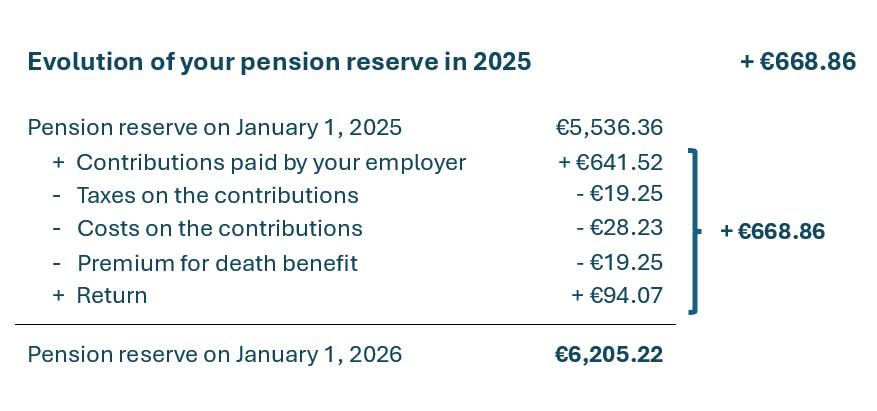

The current account shows the evolution of your staff member's pension plans reserves compared to the previous year. It will look something like this:

Will your staff members be contacted about these changes?

Yes, they can expect to receive one or more messages, depending on the situation:

- If AG has your staff members' e-mail addresses, they'll receive an e-mail from AG when it's time for the annual recalculation, letting them know that they can check the latest status of their supplementary pension entitlements on MyAG Employee Benefits. They'll also be notified by e-mail (from Sigedis or AG) as soon as their Pension Benefit Statement is available.

- If AG doesn't have your staff members' e-mail addresses but mypension.be does, they'll receive an e-mail from Sigedis in the autumn of 2026 as soon as their Pension Benefit Statement is available on mypension.be. In this Overview, they'll find the amounts on 31 December of the previous year. They can only see the most recent status in MyAG Employee Benefits, subect to prior registration on their smartphone or computer.

- If mypension.be doesn't have your staff members' e-mail addresses either, AG will notify them by letter as soon as their Pension Benefit Statement is available on MyAG Employee Benefits. We recommend that your staff members register on MyAG Employee Benefits so that they get notified when their figures are recalculated and can keep track of the latest status of their entitlements.

Encourage your staff members to register on MyAG Employee Benefits

and enter their personal e-mail address.

Need internal promotional materials and handy how-to sheets?

You'll find all of this in our MyAG Employee Benefits toolkit.

Have questions or need additional information?

Your regular contact person will gladly help you out.

💡Always up-to-date with MyAG Employee Benefits

As you can see, AG remains committed to providing you and your staff members with clear, transparent information.

MyAG Employee Benefits is where your staff members will find a comprehensive, up-to-date overview of their corporate-sponsored insurance covers and benefits.

It's their go-to source for answers to their questions and clarification on the different documents. Another selling point: they can quickly and easily contact AG via MyAG Employee Benefits.

A deep dive into the changes? Tune in to our webinar!

You might have some questions after reading this article. Or maybe you'd like to know the details for your specific pension plan? If so, be sure to sign up for our afternoon webinar on Tuesday 18 November (Dutch session) or Thursday 20 November (French session). This way, you'll be well prepared when the changes come into effect.